Where Imagination Meets Design.

Investments in the

new city center of Brașov.

Profit. More than Eur 30 million.

From the appreciation of

apartment value in the past 3 years.

“After a year where the market seemed to have reached a standstill, we currently are in the middle of the record real estate price season. Hence, the best time for investing is now. All you need to do is find the right property, the right area or the right concept. With its low density, green policies and the quality of housing, alongside the strong business cluster, which became a trigger for community development, Coresi Avantgarden is a unique opportunity for investors.

The excellent growth perspectives of this center rely on sound bases, starting from the regional and national economic forecasts. Adding to the general trends, the ROI indexes will most certainly keep growing. The completion of extensive critical infrastructure projects, including Brașov-Ghimbav Airport or the motorway connecting Brasov to Bucharest, will most certainly boost the development of the city.”

Alexandru Tîrziu

Investment Advisor

We innovate, and our

work creates value.

Commercial, financial and social value.

Coresi Neighborhood.

The area matters in investments

Green infrastructures. Energy efficiency.

Coresi Avantgarden is a mixed urban complex, connected at all levels to a fast-developing European city. Resilient to climate change and designed to the latest sustainable development standards, Coresi is a residential and business center boosting string economic and financial infrastructures, the backbone of its long-term cultural and community development.

Coresi, the new innovation engine of Brasov integrates the historical and tourist identity of the city, while closely following its background as an entrepreneurial center of continental relevance. We connect the rich history of the area to its bright future. Through intelligent management and a coherent growth strategy, a developing urban center supports a valuable mix of talents in an exceptional creative cluster, which guarantees the optimization of the local potential and return on investments.

The largest shopping

mall in Transylvania

The crafting of an experience requires… experience. The first shopping mall in the country to receive a building environmental excellence certification, Coresi Shopping Resort hosts the largest Auchan hypermarket in Transylvania, vital for the metropolitan area of Brașov and of regional relevance.

With a tradition in community development projects and leisure design, we possess the wisdom and expertise required to craft nationwide-acclaimed local experiences. Designed a social development platform, a place to be dedicated to the community, the shopping mall seamlessly combines shopping, education and leisure, a meeting point acknowledged for its modern mix of leisure alternatives, from the stores, to the food court, movie theaters, cultural hubs, gyms or open-air exercise areas.

Sports competition and festivals support the dynamics of a dedicated leisure area, boosting 1,600 sqm dedicated to the community and a green area of more than 9 hectares.

Stores

204

Visitors/year

12 million

Gross Tenancy Area (GTA)

59,000 m2

Parking spots

900

Investment value.

ROI due to the full management of the property

Benefits are adding up.

Optimizing the return on investment.

You benefit from the premium furniture packages, with preferential manufacturer rates and free consultancy.

Eur 80,000 discount/apartment*

Industries. Businesses. Residential market.

Brașov has imposed itself as one of the strongest national real estate markets, with excellent yearly absorption rates reported for each related sub-sector. As the young generations choose new lifestyles, the tenancy segment is becoming a pillar with maximum ROI for investments.

The market will continue to grow, sustained by the general constant trends, such as price increases, changing bank loan and procurement processes, the low tenancy market offer, work from home or new personal planning and development concepts.

Do you live in Paris or London? You can invest in Brașov, no need to buy a plane ticket! Smart-tech property management solutions allow for the centralized management of the entire asset portfolio, while optimizing the efficiency of operational costs and fostering better personal priority management. Our support services provide you with the tenants you need, the best rent price, invoice payment continuity and periodical property inspections.

We offer premium consultancy and permanent management or technical maintenance support services to those who see real estate business as a simple investment, and desire to entrust the administrative tasks to a reliable partner. Property management-related concerns become but a faint memory, alongside the hassle caused by bureaucracy, travels to the property and the time dedicated to the management of the property.

Why invest in real estate?

You are at a gain starting investment day one

We operate in a city that expresses its values in a visionary way, contributing to the regional development strategy and strengthening the standing of Romania among the countries with the most dynamic economies worldwide. Touching various development milestones, Brașov was ranked, in turn, as key sustainable economic growth pillar, the most important regional industrial center, or the fastest growing metropolitan area in Europe.

The constant increases in the volume of investments and spectacular local turnover leaps foster a record growth pace in the yearly net revenue per capita.

Population

633,00

County population

253,00

City population

153,00

Employee

Age

15,6%

between 0 – 14

63,7%

between 15 – 59

20,7%

over 60

Economy

72%

Active population

455€

The average salary

3,8%

Unemployment rate

Landmarks in the regional development strategy.

Brașov. The fastest growing city in Europe.

The opening of the International Airport

2023

The Regional Hospital

2025

Bucharest-Brașov Motorway

2026

European Capital of Culture Project

2028

Life Upgraded.

Invest in a sustainable project,

with outstanding development perspectives.

Heating technologies

Benefiting from a technological and design upgrade, Life Upgraded complex is a step further towards individual welfare and community development-centric urbanism. The perfect combination of experiences, innovation and design.

Life Upgraded is the first residential platform in Romania boosting sustainable heating technologies, high-performance, efficient and intelligent systems offering maximum output, with minimum consumption and pollution levels.

Guided by the landmarks of the future, we have invested in a grid of supporting systems with unique features, from smart energy-efficiency solutions and modern waste management infrastructures, to sustainable development, urban regeneration or education programs. The mixed use areas and the shopping malls foster a festive atmosphere and community focus.

Quality and innovation.

Advanced technologies for the cities of the future.

Minimum risk class.

High ROI business models.

The new residential complexes in developing metropolitan areas, mixed urban structures supported by internal value networks, with good community growth perspectives are a priority for investments. The construction quality, alongside utility or public services, the connection to the city and the weight of green areas are the fundamentals of quality housing and guarantee the long-term ROI.

The assessment process concerns the features of the property, starting from the surface area, the structure and finishes, the storage areas, the equipment or parking spots. The consecutive years of crisis have redefined the sustainability standards, turning energy-efficiency into a fundamental selection criterion in the real estate sector.

1

Return on

Investment

The profitability of the investment is given by the difference between the resale price and the purchase price, in the light of the number of property ownership years. The benefit package combines the passive profit obtained from the long-term lease of the apartments and an additional revenue derived from the appreciation of the property in time. The real estate investment rate in Brașov guarantees the return on investment.

2

Appreciation

of the Investment

As a real asset, the property has the ability of appreciating its value on the long-term, depending on the macro changes and on the general development of the urban sector it belongs to. The value of the package of properties purchased for investment purposes constantly rises, covering inflation throughout the ownership term of the purchase, a period during which the rent is a source of constant revenue.

3

Resale

profit

The prices of the residential units in the investment portfolio are constantly increasing during the ownership period, which allows for the profitable sale of the property, taking advantage of the periods characterized by an ascending price trend. The purchase of a property for the purpose of actively increasing its value, a strategy that does not only rely on the general price growth trends, is one of the solutions towards optimizing capital growth.

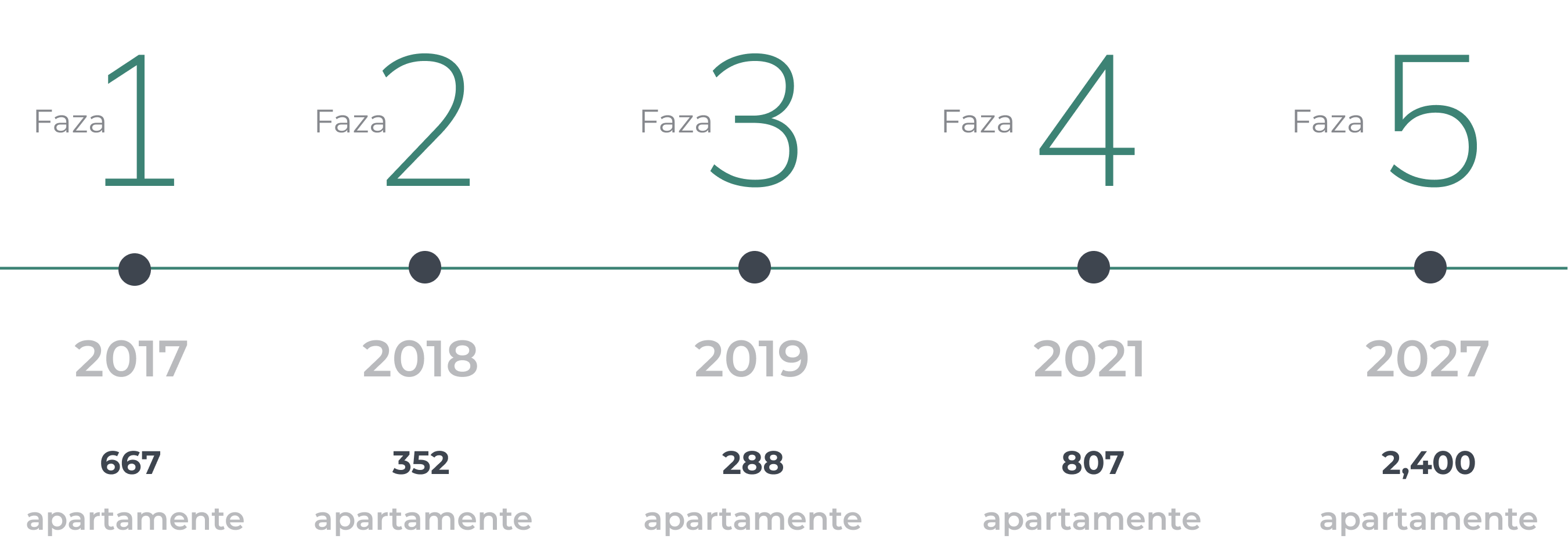

Kasper Development.

18 years of experience in excellency.

5 complex projects completed

Technical excellency and flawless quality, intertwined in unique design formulas, are the attributes that ranked us among elite real estate developers. The sustainable strategies and the long-term planning have strengthened our reputation among stable and responsible companies. Consistent to the values that have fostered our development, we put our entire expertise and experience capital to the service of people and communities. We are sticklers for details, knowing that the stories of a community start in parks and sidewalks, in movie theaters and coffee shops, to then change the lives of people and, through them, the whole world.

The widest urban regeneration project in Romania

Spreading over more than 8% of the surface area of Brașov City, Coresi Avantgarden residential complex is the widest urban regeneration plan developed so far in Romania.…

Relying on an integrated development strategy, Kasper Development, together with its partners, has set as a goal to give back to the city 100 hectares of forgotten land, and to turn the new neighborhood into the most important residential and commercial center of the city, up to the completion of the rehabilitation works.

We build long-lasting partnerships.

Collaboration is key to our company. For each project, we collaborate with our clients and strategic partners, with our consultants, with the manufacturers and the operators, alongside whom we craft a better world, day by day.

Ceetrus

Coresi Avantgarden residential platform is developed together with Ceetrus, the real estate division of the French Group Auchan, a company specializing in mixed residential complexes and celebrating 40 years of excellence on the global real estate market.

With an overall investment of Eur 250 million in Brașov, by 2025, Coresi Avantgarden Neighborhood will become a modern complex of 5,000 apartments, supported by a robust infrastructure and by a complex internal value network: schools, hospitals and medical centers, stores, coffee shops, restaurants, movie theaters, gyms, as well as educational centers and public leisure areas.

Real estate investment FAQ

How to monetize your investment?

A real estate investor generally has two investment monetization options:

- to resell the property after a certain period of time, for profit,

- to rent it for a longer period of time.

The two strategies may be combined.

Speculative resale

The purchase of a property for the sole purpose of reselling it is known as a speculative investment and it relies on the estimation that the prices will importantly rise within a certain period of time, ensuring the sale of the property for a significant profit.

During periods of economic boom, the percentage of new apartments purchased for resale is quite high, actually exceeding 50%, according to some estimations. However, this type of investment is still risky, its return being entirely dependent upon the evolution of the market.

The resale of a property with a higher market value

Investors generally assess a number of features that increase the value of a property, such as its location, the notoriety of the area, of the project, its proximity to landmarks and, especially, to business centers and office areas. The residential complex must be properly connected to the city and it must feature community development perspectives through educational centers or leisure area, from parks, restaurants, coffee shops, pubs, to clubs or movie theaters. The quality of the apartments is also assessed, including the level of finishes, their equipment or the availability of parking spots.

The return of the investment for resale

Regardless of the type of investment, an investor will most naturally be interested in the return on investment:

The calculation formula for the ROI for the purpose of resale:

Resale price – Purchase price / number of years as of the purchase date and up to the resale.

Let us suppose that you purchase the apartment for Eur 120,000 in 2022 and you resell it for Eur 144,000 in 2026. In the case of this resale, the profit obtained is of Eur 24,000 obtained in 5 years, with a yearly profit of approximately Eur 4,800.

If you lease that property in exchange for Eur 500, you will obtain a yearly revenue of Eur 6,000, i.e., Eur 30,000 in 5 years. If the return on investment obtained through lease is similar to the one obtained through resale, it might be worth it for you to wait until the property value increases even more.

However, in this case as well, you obtained a passive profit from the long-term lease and an additional revenue from the appreciation of the property in time.

Who prefers long-term lease?

During times of less important appreciation, most investors prefer to obtain profit out of the lease of the properties. In the case of the long-term lease, the potential return on investment for the residential segment may reach 6% – 7% or even 8% per year, in Eur. In the case of short-term rental, the return on investment ranges between 10% and 15%. The constant growth of the lease market encourages important players to tackle this sector, such as global financial institutions, investment funds, pension funds, which purchase the projects from developers and operate them on the lease market.

The benefits of the lease

The alternative may suit both those who make cash purchases, and those who contract bank loans. For the latter category, the pros include the accessibility of funding and the fact that they can use rent money to cover the bank installment or at least an important part of it.

There are two important indicators for this alternative: the return on investment and the amortization period.

Based on this information, using the potential gross tenancy multiplier, apply the following calculation formula:

Property purchase cost / Monthly rent x 12

This will give you the number of years within which you will fully recover your real estate investment.

For instance, if you want to purchase a property with a price of Eur 120,000, with a monthly rent of Eur 500, the amortization period will be of 20 years.

However, in addition to the amortization value, you also want to find out the return on investment, to see how profitable the investment is, as compared to other types of investments.

To do that, you need to identify the percentage of the yearly rent out of the property purchase cost.

500 x 12 = Eur 6,000/year

Eur 6,000 / Eur 120,000 x 100% = 5%.

Thus, in the case of the previous example, the gross ROI is of 5%, i.e., Eur 6,000 per year, a satisfying rate for a real estate investment.

To set the net ROI of the property, you also need to deduct out of the yearly rent amount the expenses related to property tax, vacancy months, and other furnishing expenses.